Women as insurance decision-makers

They hold significant financial power as household breadwinners and business owners globally.

Did you know that?

[xyz-ihs snippet=”Ad-sense”]

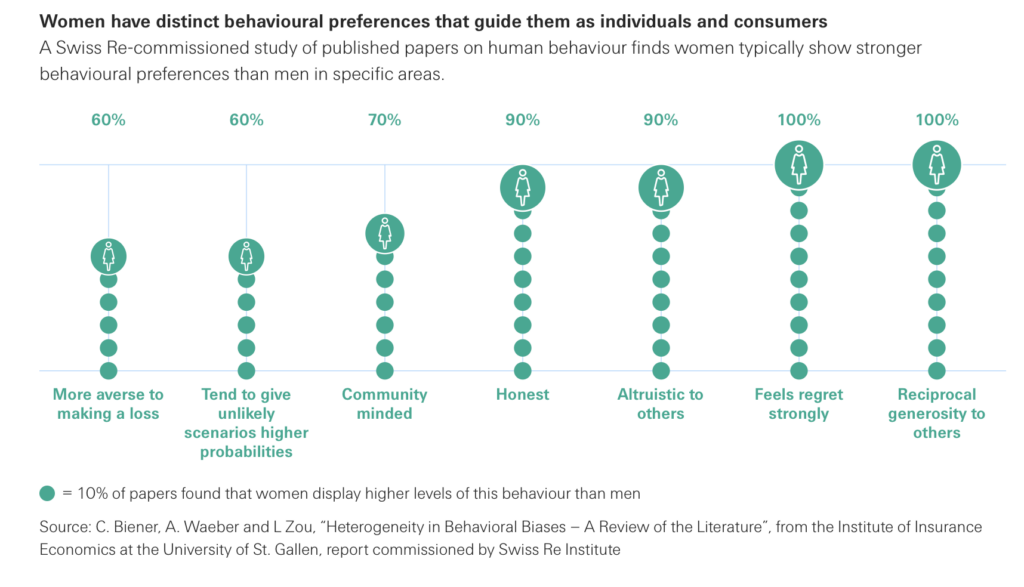

women are also key decision-makers for insurance purchases, but are often not visible as a target purchaser for many insurance products. This matters, since Swiss Re-commissioned research shows that women have different behavioural preferences to men.

Insurers that understand women’s behavioural

[xyz-ihs snippet=”Ad-sense”]

differences are better positioned to serve them as customers. This may mean adapting insurance value chains from product design to distribution, to better fit women. Women’s behavioural preferences influence how they purchase insurance. For example, studies show that women tend to spend more of their household income on healthcare and insurance than men.

[xyz-ihs snippet=”Ad-sense”]

Business owners are increasingly women.

[xyz-ihs snippet=”Ad-sense”]

For example, the US has more than a million women-owned firms, which reported about USD 1.8 trillion in revenue and employed more than 10 million people in 2018. However, women face a persistent funding gap. Like all entrepreneurs they also face risks to running their businesses, and insurance plays a key role in providing protection to their employees, property and income.

Governments are working to make

[xyz-ihs snippet=”Ad-sense”]

[xyz-ihs snippet=”Ad-sense”]

We recognise and acknowledge

[xyz-ihs snippet=”Ad-sense”]

[xyz-ihs snippet=”Ad-sense”]

that gender identity and expression are personal to an individual and are not limited only to male and female. We focus on women as part of Swiss Re’s commitment to the United Nations Sustainable Development Goal 5. This report provides our initial findings on this topic and we hope it will spark further interest.