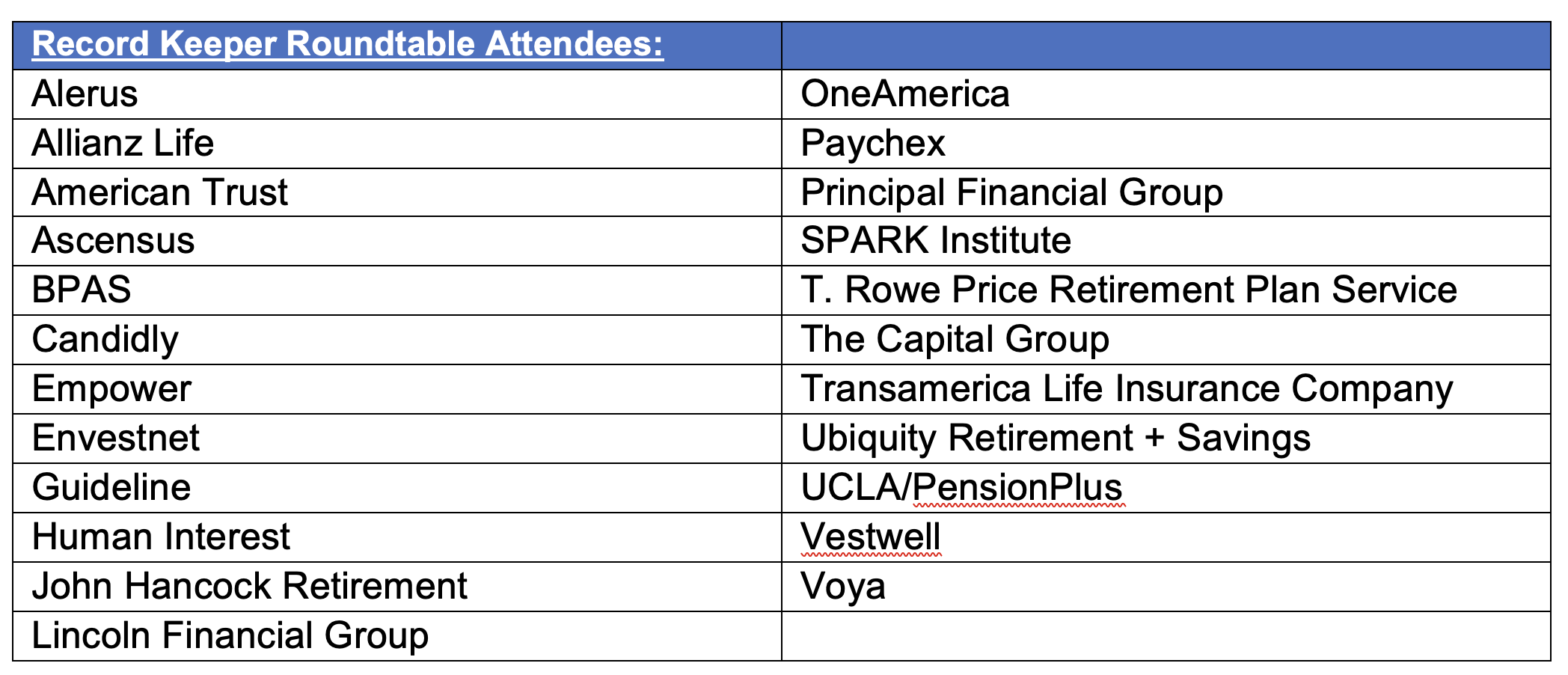

Within the sophisticated and interdependent ecosystem that makes outlined contribution plans so tough to navigate, the whole lot begins with information, making file keepers the lynchpin. On the fifth annual RPA Report Keeper Roundtable & Thinktank held in New York Metropolis and hosted by WealthManagement.com on Sept. 6-7 earlier than the 2023 WealthManagement.com Business Awards (The Wealthies), senior leaders from many of the main companies gathered to debate their greatest alternatives, challenges and threats, in addition to methods to higher collaborate not simply with companions however with one another.

The main themes all through the symposium included:

- Serving the underserved 97% of contributors

- Protected and acceptable use of participant information

- Leveraging know-how

- Serving small companies via wealth advisors

The consensus was that, although very tough, if the trade doesn’t higher serve the 97%, the federal government might step in.

DC file keepers, particularly these targeted on RPAs, face daunting challenges and wonderful alternatives as properly, which embody:

- Conversion of wealth, retirement and advantages on the office

- Price compression fueling consolidation

- New legal guidelines and rising lawsuits

They depend upon many companions to assist and collaborate with who additionally face their very own challenges and doubtlessly divergent priorities. Of the estimated 288,000 energetic monetary advisors, Cerulli estimates simply 13,000 have 50% or extra of their income from DC plans whereas 63,000 could have important DC property however don’t concentrate on them, leaving one other 100,000+ with not less than one plan, a lot of whom have relations with enterprise homeowners.

Within the opening dialogue, UCLA Professor Shomo Benartzi, founder and CEO of PensionPlus who gained a Wealthies award for in-plan retirement earnings, bluntly said that with out information, the trade can not transfer the needle to serve the underserved and supply retirement earnings. Laurel Taylor, CEO and founding father of Candidly, who additionally gained a Wealthies Award, warned that customers anticipate worth in trade for information.

Tim Rouse, SPARK’S Government Director, mentioned primarily based on focus teams and surveys, every member of the DC ecosystem had a distinct perspective about information, together with:

- Plan sponsors imagine they personal the information (or not less than are the stewards) and are keen to lend, not give it to suppliers underneath the proper circumstances

- Contributors wish to be helped not exploited

- Advisors perceive the necessity for optimistic election

- Report keepers are involved about lawsuits and the power to make use of minimal information to serve the plan with out permission

One file keeper who tried to produce information to advisors and assist them leverage alternatives with contributors was disenchanted that the majority didn’t comply with up. Kevin Collins, head of retirement plan providers at T Rowe Worth, noticed that advisors are within the early levels of leveraging wealth alternatives inside DC plans and growing the wanted wealth stack. Alternatively, wealth companies like Inventive Planning do a great job, in accordance the Wayne Park, CEO at John Hancock Retirement, by making a holistic monetary planning taking a look at all property, not simply DC account balances or IRA rollover alternatives.

John Farmakis, SVP of enterprise improvement at Ubiquity Retirement, raised the plain query of how you can get to the 275,000 wealth advisors not targeted on DC plans. Todd Hedges, senior supervisor at Paychex, mentioned he’s working with dealer/sellers who’re keen to have interaction with their wealth advisors by offering information on who could have shoppers that contact companies. Whereas early levels, Aaron Schumm, CEO and founder at Vestwell, noticed a rising curiosity by wealth advisors in DC plans although many unbiased dealer/sellers are involved about danger mitigation with the untrained reps.

Are advisors not leveraging participant information as a result of most aren’t of them aren’t enticing alternatives, puzzled Mark Alley, nationwide market president at Alerus. As a result of the complete monetary service trade is targeted on a really small proportion of individuals, Kevin Collins urged that advisors could also be as properly.

ChatGPT is essentially unused and never properly understood by the DC trade at the same time as all of us notice its huge potential. Candidly’s Taylor, who beforehand labored at Google, warned that earlier than the trade engages, the federal government wants to manage massive language fashions. The DC trade might lag behind due to compliance considerations.

The group famous the trade was not doing a great job partaking contributors the place they’re (versus on their web sites) and anticipating once they would possibly need assistance. Additionally they requested whether or not now we have an earnings moderately than a retirement financial savings hole. And although expertise is turning into simpler to search out, the group questioned whether or not distant work is working particularly for much less expertise workers, which might trigger retention points.

Ralph Ferraro, head of retirement plan providers at Lincoln Monetary, urged the trade ought to collaborate on monetary literacy whereas Jeff Rosenberger, COO at Guideline, questioned whether or not “collaboration” was too robust a phrase and urged “standardization” may be extra lifelike and whether or not we should always lean in on a neater aim like extra utilization of auto options.

Retirement earnings will proceed to wrestle with out collaboration of suppliers, advisors and plan sponsors, inflicting Mike DeFeo, Allianz Life’s head of DC distribution, to ask the place it’s on file keepers’ precedence listing. John Hancock’s Park famous the problem in making a living on a declining asset whereas one other attendee was shocked by the lack of knowledge concerning the topic because the trade nonetheless makes an attempt to check retirement earnings options to mutual funds, for instance. Possibly participant name facilities should be higher educated on the topic as properly, famous Jack Barry head of product improvement at John Hancock.

Wonderful insights from a totally engaged group of leaders from prime suppliers, outlining the immense alternatives of just about $10 trillion in DC property (one other $12+ trillion in IRAs), 700,000+ DC plans and rising attributable to state mandates and SECURE 2.0 tax credit, and the possibility to serve the 80 million DC contributors whereas the challenges appear simply as daunting as the specter of lawsuits and authorities intervention looms.

Fred Barstein is founder and CEO of TRAU, TPSU and 401kTV.